Get tips for easy apartment living and ideas for fun things to do in the area!

Monday, December 29, 2014

Sunday, December 21, 2014

From Business Suits to Blue Jeans ...

Dress

codes are catching up with the modern emphasis on work-life balance and the

need to blend the personal with the professional, explains LearnVest human

resources associate Sarah DeGrazia. “I think business casual exists to

make people feel more comfortable and be their most productive selves,” she

says. “It reflects a cultural shift toward being more relaxed.”

Industry: Technology

Industry: Professional Training Development

Industry: Marketing & Advertising

Industry: Corporate Finance

According

to DeGrazia, business casual for men usually means skipping the suit and tie in

favor of dress pants, a collared shirt and a belt. But when it comes to women,

settling on a no-fail business casual outfit is more difficult.

Generally,

women can wear any type of skirt or dress with a hem that goes past the knee,

as long as the cut isn’t too revealing on top, or a tailored pair of dress

pants with a button-down or blouse. Closed-toed shoes are a must, though

both heels and flats are acceptable.

If

you don't know what to expect in a new job, DeGrazia recommends asking a friend

in the field. She also sees no harm in asking your team members or boss, as

long as it's not the night before the interview. Today many companies also have

websites or social media accounts that feature their employees, so do your

homework.

As

for business-casual don’ts? Generally speaking, “no jeans, no sneakers, no

flip-flops, no sweatshirts,” says DeGrazia. (Though, if you happen to

work in Silicon Valley—or an industry like it—the opposite might be true.)

If

in doubt, consider playing it safe by opting for something more formal. “I

can’t imagine a situation in which a candidate would be penalized for

overdressing,” DeGrazia assures us. "Even if you show up in a suit and

everyone else is wearing jeans, you can always remove the jacket. Especially in

an interview setting, you never want something under your control—like your

outfit—to act as a distraction."

Still,

what’s appropriate can vary by industry, age and even location. While tech

employees can often get away with jeans and tees, a job in finance most likely

means a suit and tie every day. Each industry has their norms, so we asked four

professional in different fields: What does "business casual" mean

for you?

The Techie

Vihang Mehta, 23, Menlo Park, CalifIndustry: Technology

As a software engineer at Facebook, Vihang Mehta's office wear

is more casual than business casual. He says that jeans and T-shirts are the

norm for everyone from lower-level employees to big bosses—C.E.O. and founder

Mark Zuckerberg hardly wears anything else.

Outfits do vary by each employee’s personal preference, and some

people opt to go slightly more formal. But the majority of employees are fairly

young, and most stick with casual wear—even those who meet clients. Mehta says

his office even does “Corporate Fridays” as a fun twist on the old office

tradition. “People dress up just for fun, or wear a suit.”

The Consultant

Myles Miller, 50, Harrisburg, PennIndustry: Professional Training Development

Around the offices of education and training consulting firm

LeadUp, the dress code is all about what employees feel comfortable wearing,

says founder and C.E.O. Myles Miller.

But Miller points out that employees, including himself, spend

no more than 10 hours per week at headquarters. Most of their services are

performed on-site at the offices of other companies, which means they need to

be dressed appropriately for industries such as defense, pharmaceuticals,

retail, hospitality, government and manufacturing. “That’s something I’ve seen

changing over the past few years,” Miller adds. “How you dress really does

depend on who you’re going to see.”

If Miller is booked for a speaking engagement, he always checks

the dress code with the event planners—although he’s noticed that even some of

the Fortune 100 companies he’s worked with are moving toward more casual daily

attire. But he always wears a suit and tie when he first meets a client:

"I'm still somewhat of a traditionalist," he says.

The Ad Exec

Amanda Pekoe, 33, New York CityIndustry: Marketing & Advertising

Amanda Pekoe C.E.O. and founder of theatrical marketing and

advertising company The Pekoe Group, aims to keep her office dress code

professional and fun at the same time. She asks that her employees—all under

age 35—sport orange or red, the company’s official colors, when they're in

front of clients. "It can be something simple, like an orange blazer or

necklace for the ladies, and for the men, a tie or pocket square," she

says. "I want everyone to look professional, but I don’t want them to look

too stuffy.”

Her personal go-to outfits include button-down silk blouses with

a pair of dress pants or nice jeans, a blouse with a blazer or a dress with a

cardigan. Pekoe mostly sticks with flats for comfort, but if she wears heels,

opts for wedges instead of stilettos. “I would say 99% of the time I’m rocking

a big statement necklace,” she says. “Usually the women in the office are using

accessories and jewelry as a way of pull the whole look together and make it

feel business-y, but also hip and trendy,” she adds, while “the guys rock out

really fun shoes” or spice up an outfit with colorful socks or bowties.

The Finance Guy

Julian Gilliatt, 22, New York CityIndustry: Corporate Finance

For Julian Gilliatt, a financial analyst at Bloomingdale’s

corporate offices, business casual means something more formal.

On any given day, he wears a dress shirt and dress pants—brown

usually, black when he wants something more conservative—with a matching belt

and shoes. He swaps in a linen shirt for the office’s casual Friday.

Business formal is the dress code at the VP level, with execs

wearing a suit and tie. In special situations, like dinner with colleagues,

choosing the appropriate attire can be tricky, Gilliatt says.

“It’s dependent on the personality of your team,” he advises.

“You could be going to a nice dinner with your boss and dress business formal,

but if your boss is taking you and your team out for drinks or something, then

it’s much better to go casual than be completely overdressed.”

Thursday, December 18, 2014

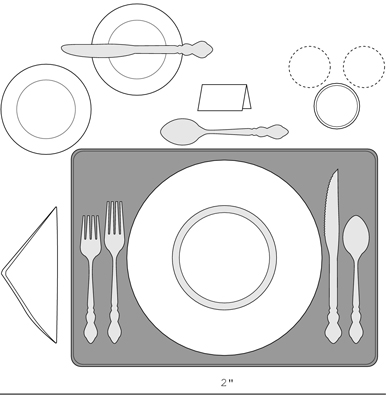

How to Properly Set your Holiday Dining Table

If you're hosting a Thanksgiving or Christmas dinner, know how to set a holiday table. A great table setting enhances your formal or casual — but definitely festive — atmosphere. Understanding how to set a dinner table is essential during the holiday season, and is also important for hosting any formal dinners.

Keep your table settings simple for dinner parties: Keep utensils, glassware, and dinnerware to a minimum. Don’t set out a plethora of utensils unless your guests will actually need them during the course of the meal.

![[Credit: ©iStockphoto.com/Lisa Thornberg 2011]](http://media.wiley.com/Lux/07/346107.image0.jpg)

Credit: ©iStockphoto.com/Lisa Thornberg 2011

Casual table setting

This is an example of a simple table setting to use if you want to serve a salad, soup, bread, a main course, and a beverage for dinner. If you serve coffee and dessert, you can place these items on the table right before serving them.

An informal place setting can add style to your dinner party.

- Place dinner plates approximately 2 inches from the table’s edge and center them squarely in front of each chair.

- Put soup bowls on top of the dinner plates.

- Salad plates go above the forks to the left side of the dinner plate.

- Position bread plates slightly above the salad plate closer to the dessert fork.

- Flatware should be laid out in the order that guests will use it: Work your way from the outside in. Forks belong on the left of the dinner plate; knives and spoons go to the right. Knife edges should always face the dinner plate. Butter knives should be laid flat on the bread plate with the cutting edge, again, facing in the direction of the dinner plate. Dessert forks or spoons can be placed horizontally at the top of the dinner plate.

- Place water glasses above the dinner knife. Optional red and white wine glasses or champagne flutes are staggered around the water glass.

- Napkins go to the left of the plate, inside a drinking glass, or in the center of the plate.

- Place cards (perfectly optional) work best placed above the dessert utensil, centered with the plate.

Formal table setting

If you’re hosting a Passover Seder or a Christmas dinner, you may opt for a more formal table setting. For a full-blown formal dinner party, you can add more detail to your place settings as needed: The following list corresponds to the numbers in the illustration.

A formal place setting has many pieces; add or delete them according to your menu.

- Napkin (1)

- Salad fork (2)

- Dinner fork (3)

- Dessert fork (4)

- Bread and butter plate, with butter knife (5)

- Dinner plate (6)

- Dinner knife (7)

- Teaspoon (8)

- Soup spoon (9)

- Cocktail fork (10)

- Water glass (11)

- Red wine glass (12)

- White wine glass (13)

Proper table settings do not need to include every utensil. All sorts of utensils are laid out in this example table setting, but don’t add them to your table unless you intend to use each piece with a course you're serving for dinner or dessert.

Source: www.dummies.com

Friday, December 12, 2014

What is a Price Book?

You’ve

been hearing about it on the news, food prices are on the rise and the drought

in California only makes it worse. Here is a way to shop offensively vs

defensively: The Price Book

A price

book is a power tool for tracking prices, products and sales, so you'll always

know when a bargain is truly a bargain.

A price

book records price variations over time--and between different merchants. For

each grocery item you buy, a price book shows you a target price and sets out

sales cycles for products you buy regularly.

By

knowing that your target price for salad dressing is $1.19, and that the sales

cycle is 8 weeks long, you'll be prepared to stock up when prices are low--and

rely on the pantry until the next sale, two months later.

How To Make A Price Book

First,

understand that form is unimportant. Low-tech tightwads use a three-ring binder

or spiral notebook to track price book info. Planner aficionados devote a

tabbed section to price book pages, while smartphone power users grab dedicated

price book apps to track their purchases.

Whatever

the form, the heart of the price book is the product page. Each page tracks

price information for a single staple product. Down the page, you'll list the

date, store, brand, size and price, and unit price for that product. Over time,

you'll be able to identify the best regular price, recognize special sales, and

track sale cycles for that product.

Our

shopper can buy 8-ounce cans of tomato sauce for a regular supermarket price of

32 cents. Her warehouse store sells bulk cans of tomato sauce for a sharply

lower unit price. However, the best buy occurs when the supermarket puts

8-ounce cans on sale at 10 for $1.

Armed

with the price book analysis, our shopper has learned to stock up on 8-ounce

cans of tomato sauce during supermarket sales.

By

continuing to track the price of tomato sauce, she can learn the sale cycle:

how often to expect those 10/$1 deals to occur. In her area, that's about every

6 weeks--so she'll purchase enough on sale to cover her family's needs until

the next sale.

Setting Up and Using Your Price

Book

You're

sold on the concept of a price book. You know it will save money, trim time and

lighten shopping stress.

Now for

the fun! Follow these tips to set up and use your new price book.

You've

found a small notebook or printed our price book

template and tucked

several copies in a three-ring binder. Next step: gather and record your data.

Itemized

grocery store receipts are a price book's best friend. On them, you'll find

identified and itemized lists of products you buy and use.

Jumpstart

your price book by recording data from every receipt you can find.

For

brevity, develop a list of store codes. Use a short abbreviation for each

supermarket, discount store and warehouse store you patronize.

Keep a

calculator handy for unit price calculations! To find any item's unit price,

divide the cost of the item by the number of units OR you can often find the

unit price calculated on the shelf tag, while shopping.

On The Firing Line

You've

scrounged for receipts, entered your data, and now it's time to shop. Like good

wine, a price book's value increases with age. At first, you'll be filling in

initial entries for many, many product pages--but as time passes, the price

book's growth will give you a clear view of the sales cycle.

Build

your baby price book each time you shop. See a great special at Supermarket A,

but you don't need the product that week? Record it in your price book. You'll

know to return next sale cycle, ready to buy.

With a

mature price book, item entries slow. Once you've sampled prices at several

supermarkets, the discount store and warehouse store, only enter a new price if

it is lower than your existing entries.

As your

price book matures, be prepared for surprises! Often, the dedicated warehouse

store bulk-buyer will discover that she's been paying premium prices for bulk

goods. No single traditional supermarket has the "lowest prices" in

every area, no matter what their advertising jingles say. Approach the price book

exercise with an open mind; you'll find surprising bargains--and high price

shocks--in the most amazing places.

Be aware:

some price book shoppers have reported episodes of being confronted by

supermarket personnel when they make price book entries at the store. A clear

and polite explanation ("This is my personal price record; I'm

tight-wadding these days. You've got a great deal on white potatoes this

week!") should reassure store managers that you're not a snooper-shopper

from a competing store. Don't stand for harassment! Any further confrontation

should be reported to the chain's higher-ups for action.

Ready, Set, Save!

Over

time, you'll build an impressive data bank of local supermarket pricing

information. You'll know that name-brand Mexican food products will be offered

at the year's lowest prices just before Cinco de Mayo, the 5th of May. You'll

know when to stock up on steaks, or sodas, or diet foods. You'll understand

that canned tuna will be offered at 3/$1 every six weeks--and you'll purchase

six weeks' worth of tuna during that buying opportunity.

You'll

also know, at a glance, when to buy in bulk from the warehouse store and when

to look for a better deal at the supermarket.

Not all

bulk purchases represent true bargains. Armed with a price book, you'll know to

a fraction of a penny when to load up on the big bag of flour, and when to pass

it up in favor of the supermarket's loss leader of the week.

Most of

all, a price book will reveal your target price: a realistic, rock-bottom price

goal for each item listed in your book. Whether it's cereal for $1.99 per box

or detergent at 9 cents per use, you'll have the information you need to know

when a bargain is truly a bargain.

Price

books. They give you a leg up on the chaotic, ever-changing supermarket price

game. Save time, save money and get organized at the supermarket with a price

book!

Tuesday, December 9, 2014

Saturday, December 6, 2014

Tuesday, December 2, 2014

Sunday, November 30, 2014

Thursday, November 27, 2014

Tuesday, November 25, 2014

Black Friday Shopping Tips

We all know Black Friday offers the best holiday season shopping deals, but they only come to those who are prepared and in the right place at the right time. Here are some tips to help you make the most of the sales and discounts so you get the most bang for your buck.

Do Your Research

If you are planning on making a special purchase of a big-ticket item based on a Black Friday sale, it is important to remember to check consumer reports and read consumer reviews of the item before you decide to make the purchase. If the product is bad, just because you got it for cheap doesn’t make it a good deal. Take the time to make sure it’s a quality product and worth getting up early or staying up late for the price cut.

Browse the Deals Before You Go

Thanks to my site, you can get a good idea of what deals will be where well before Black Friday shopping starts. Knowing which retailers are going to have what on sale and when before the big day will help you decide where and when you want to go, will help with budgeting, and will help you see who you have left to shop for. As you browse the deals, make a list with the product, who it’s for, the price, the location, and any special hours for the sale.

Compare Prices Before You Head Out

Shop around to see what the average retail price of an item is before you leave, so you can go to the store that is offering the best deal. Check to see what usually comes with the item you are looking for, and what the store is offering. Many stores offer”stripped down” versions of products, which means you will have to spend money on accessories. Take time to see what accessories you will need to determine if the deal is really worth it or not.

Bring Ads with You

Bring sales ads with you so you can have them available if you need to call a store out on their “lowest price guarantee.” Most stores have a policy that will allow them to match or beat a lower advertised price, but will require you to show the ad as proof to process the price difference. Generally speaking, the store policy will not apply to online advertised deals, even in the case of the store website due to online only deals, but you can always print the web page where you saw the deal with the advertised price and give it a shot.

Use Store Credit Cards

I’m not saying go out and max your cards. You will still have to practice budget savvy shopping and make regular payments to avoid hefty interest charges, but many stores offer extra discounts and warranties if you make purchases on your store card. This, when paid in full as if it were cash, can offer extra savings benefits.

Early Bird and Night Owl Specials

Many stores advertise early bird deals, generally between 4 and 11 a.m., to help draw in the crowd, but also offer night owl specials between the hours of midnight and 4 a.m. to draw in the crowd that doesn’t like to get up early, but would rather stay up late. Cashing in on these deals is not only a good way to beat the crowd, but it’s a good way to guarantee the getting will be good, because typically, once the deals are gone, they are gone.

Familiarize Yourself with Store Policy

As stores are becoming stricter on return and exchange policies, knowing the store policies before you go can help you decide where to shop and what places to avoid. Most stores are now starting to charge a restocking fee and closing the return window, so customers do not have as long to return a product. The amount of time you have to return something is important since you’re buying nearly a month in advance. Having a receipt is also very important, because no receipt often means no return.

Don’t Forget the Gift Receipt

Many stores are printing a gift receipt so you can include a receipt with the gift in the event of return or exchange, without divulging how much money you spent on the item. While many stores do this automatically for holiday season purchases, it is important to ask for one so you can be sure to have it for the recipient.

Saturday, November 22, 2014

Don't Make these Common Startup Mistakes

4 Ways Startup

Employers Fail at Work-Life Balance

The startup work environment is stressful by nature. Entrepreneurs work hard

to run their businesses and make ends meet. But when founders are very

concerned about their startup’s success, they may overlook the needs of

their employees.

The reality is, many people who work for startups,

particularly in the technology arena,

struggle with work-life balance. In fact, some companies have even gone as far

as to find ways to extend the amount of time employees can work.

Instead of forcing employees to sacrifice their personal

lives, startup employers need to create more work-life balance at their

companies. Here are four ways startup employers fail at work-life balance and

what could be done about it:

1. Overlooking personal lives and

needs of staff.

Startup employees are humans, too. They have spouses,

children, loved ones to care for and unexpected life events. If startup

employers want to increase their employees’ happiness, they need to address

their personal needs.

For example, according to Pew Research, half of

working parents with children younger than 18 say it’s difficult to balance

their careers with the responsibilities of raising a family. If an employee

needs more time to be with family or other personal needs, try to work with his

or her schedule.

Also, let employees telecommute or offer the

occasional half-day. If a staff person isn’t required to meet with a

client or customer in person on a particular day and the job can be done from

home, there’s no reason he or she needs to come into the office.

2. Not addressing burnout

immediately.

Most people who apply for startup jobs realize that they’ll

be working long hours. But regardless of how much a person loves his or her

job, burnout may be inevitable when working in excess of 80 hours a week.

Startup employers who have employees on demanding work

schedules must have a plan in place for when a staffer experiences

burnout. Whether it’s giving the person paid time off from work or shortening

the workload for a week, give the employee time to recharge.

3. Piling on responsibilities for

employees.

Many startups can’t hire a lot of talent, especially in the

early stages. This is why some startup employees are required to wear many hats

and take on responsibilities outside of their job description.

When giving out the extra assignments, ask employees

if they’re physically and mentally able to take them on. Once they have

accepted the tasks, continue to check in with them to be sure they aren’t

feeling overworked or exhausted.

4. Ignoring mental illness and

stress.

Startups can be extremely stressful work environments and

require employees to work longer hours in the office. Because of this,

employees can be prone to depression and stress. Research by the Finnish Institute of

Mental Health showed that people who work more than 11 hours a

day are more prone to work-related depression.

Startup employees are likely to have days when they’re

required to work more than eight hours a day. But if this becomes a common

occurrence, take action to ensure staffers remain happy, healthy and productive.

Depression can negatively affect an employee’s performance

at work. If someone is showing symptoms of stress or depression, address the

situation immediately. Lesson the workload or let the person take time off

from work.

Thursday, November 20, 2014

Beware of the Masque Attack Hackers

There was the potential for hacks using a newly identified technique known as the "Masque Attack," the government said in an online bulletin from the National Cybersecurity and Communications Integration Center and the U.S. Computer Emergency Readiness Teams.

The network security company, FireEye Inc, disclosed the vulnerability behind the "Masque Attack" earlier this week, saying it had been exploited to launch a campaign dubbed "WireLurker" and that more attacks could follow.

Hackers could potentially steal login credentials, access sensitive data stored on iOS devices and remotely monitor activity on those devices, the government said.

Such attacks could be avoided if iPad and iPhone users only installed apps from Apple's App Store or from their own organizations, it said.

Users should not click "Install" from pop-ups when surfing the web. If iOS flashes a warning that says "Untrusted App Developer," users should click on "Don't Trust" and immediately uninstall the app, the bulletin said.

Representatives of Apple could not immediately be reached for comment.

(Reporting by Jim Finkle; Editing by Bernadette Baum)

Tuesday, November 18, 2014

Managing Your Credit Report

If you find information on your credit report that doesn't belong to you, one of two things happened: Either someone stole your identity, or there's an error in the credit reporting system. You definitely don't want the problem to be identity theft, but fixing credit report errors can also be a complicated, frustrating endeavor.

Lisa Marie Allen of Fremont, Calif., knows this from experience. When she got a new job, her employer ran a credit check and saw 10 negative items on her credit report. Allen was shocked, not to mention concerned someone had stolen her identity, according to ABC 7 San Francisco, which reported her story. It wasn't a case of fraud: Her credit history had been mixed with that of another Lisa Marie Allen.

Allen was dealing with something called a mixed file, which often happens to people with common names. In Allen's case, it seemed the other Lisa (who reportedly lives in Texas) had $350,000 in debt that was showing up on California Lisa's credit reports. The two not only share a name, they also had the same Social Security number, further muddying the difference between the women.

California Lisa straightened out the problem with the Social Security Administration, ABC reports, but the cleanup wasn't as swift with the credit reporting agencies. She eventually had to hire a lawyer for help clearing her reports of information that wasn't hers.Ideally, consumers can manage something like this themselves, because each of the credit reporting agencies provides clear instructions on their websites for disputing inaccurate credit report information. For some reason Allen never figured out, the dispute process wasn't working for her. She's not the only one who has struggled to remove inaccuracies from credit reports, even though it seems like it should be a straightforward process. It's frustrating, but persistence is key to maintaining an error-free credit report. That's one of the many reasons you should check your free annual credit reports regularly.

Her issues are now resolved, ABC reports, but while she waited for her corrected file, Allen couldn't open a bank account or get a car loan, her lawyer told ABC. Credit reporting errors are fixable, but they can be costly in the meantime, which is why you want to know of any issues as soon as they arise.

Saturday, November 15, 2014

College Prices on the Rise ... Again!

College

prices in the U.S. have again increased faster than the rate of inflation,

extending a decades-long pattern of higher-education costs.

Tuition

and fees at private nonprofit colleges climbed 3.7 percent on average to

$31,231 this academic year, according to a report today by the College Board. For in-state residents at

four-year public schools, costs rose 2.9 percent to $9,139. Inflation, measured

by the personal consumption expenditures index, rose 1.4 percent in the year

through September.

The good news is that increases this year are smaller than the average for the past five-, 10- and 30-year periods, and more public school students saw no increase at all, the New York-based College Board said. The bad news is that cumulative undergraduate debt is rising as real incomes haven't grown for more than a decade except for top earners, said Sandy Baum and Jennifer Ma, the report's authors.

"College price increases are not

accelerating. But they are accumulating," Baum and Ma wrote. The widening

gap in pay between college and high school graduates is more about

"declining wages at the lower end of the distribution, as opposed to

increases for those with a college education."

As families continue to struggle to

afford college, the Obama Administration plans to introduce a ratings system to

show which colleges provide the most value, with metrics such as graduation

rates and average student debt.

Room, Board

Including room and board, costs average $18,943 for in-state students at public schools and $32,762 for out-of state residents. At private schools, the bill is $42,419. Those amounts don't include items that aren't directly billed by the school, such as transportation, books and laundry.

A decade ago, tuition and fees jumped

10.4 percent for in-state students at four-year public colleges and 5.8 percent

at private schools, according to the nonprofit College Board, which administers

the SAT entrance exam and whose members include universities.

Tuition and fees have

been outpacing overall inflation for decades.

Costs didn't rise for about 12 percent of full-time students at four-year public colleges, up from 4 percent a decade ago, according to the College Board.

After accounting for financial-aid grants, which about two-thirds of full-time students receive, actual costs are lower than the published prices.

Total Borrowing

The total amount borrowed for college by all students, $106 billion, declined 13 percent in 2013-2014 from three years earlier, according to the report. More than 90 percent of the loans were government backed.

Some of the drop in borrowing may reflect the decline in college enrollment, including at for-profit colleges, where students typically borrow more than their nonprofit counterparts, Baum said in an interview. Some students may also be more cautious about taking on education debt, she said.

Higher education enrollment, including

at two-year colleges, declined in 2013 for a second straight year, the U.S.

Census Bureau said in a September report.

In a separate study, cumulative student

debt for class of 2013 graduates at nonprofit colleges who borrowed was

$28,400, up from $27,850 a year earlier, according to The Institute for College

Access & Success, an Oakland, California-based advocacy group.

About 69 percent of college seniors at

those four-year schools graduated with student debt, TICAS said today. Last

year, the group's report included for-profit schools.

To

contact the editors responsible for this story: Lisa Wolfson at lwolfson@bloomberg.net

Chris Staiti

Thursday, November 13, 2014

Here is a GREAT reason to live at The Grove Garden Apartments or Peartree Apartments, both conveniently located in the beautiful town of Sunnyvale, CA.

The number of violent crimes across the United States is estimated to have dropped by 4.4% in 2013 from the year before, according to data recently released by the FBI. In all, the number of such crimes declined by nearly 15% in the last 10 years.

Putting this drop into context, John Roman, senior fellow at the Urban Institute, told 24/7 Wall St., "A 4.4% reduction in violent crime is astonishing. If you saw a similar increase in GDP, or a similar decrease in unemployment, it would be huge national news."

Even as the nation becomes increasingly safe, a number of large U.S. cities still stood out for their low crime rate. Across the country, 368 violent crimes were reported for every 100,000 people last year. Such crimes include murder, rape, aggravated assault, and robbery. In America’s 10 safest cities, there were fewer than 100 such crimes for every 100,000 people. Based on violent crime data published by the FBI’s 2013 Uniform Crime Report, these are America’s safest cities.

ALSO READ: Companies Paying Americans the Least

In many of the safest cities, murder counts were extremely low. Nationwide, the FBI recorded 14,196 murders in 2013, or 4.5 murders for every 100,000 people. By comparison, each of America’s 10 safest cities reported less than five murders overall last year. Naperville, Illinois and Frisco, Texas did not report a single murder in 2013.

In addition to a low violent crime rate, the nation’s safest cities largely had extremely low property crime rates as well. As of last year, eight of these large cities were among the 25 cities with the lowest property crime rates. Nationwide, there were 2,731 such crimes for every 100,000 people. By comparison, in three of the safest cities -- Naperville, Illinois; Irvine, California; and Cary, North Carolina -- there were fewer than 1,400 property crimes per 100,000 residents.

According to the Urban Institute's Roman, reducing crime “is about economic policy, it’s not about crime policy.” He added, “The idea is that if you make a city more economically vibrant, you attract people to that city who bring with them resources to try and make that city better. And those resources benefit all of the people who are already there.”

The especially high household incomes in area with low crime rates, and the generally low incomes in areas with higher crime rates, appear to support Roman’s statement. In fact, Frisco and Naperville had the highest median incomes among large U.S. cities. In all, eight of the nation’s safest cities had median household incomes of more than $70,000 last year. By comparison, the median household income across the U.S. was $52,250 in 2013.

Education is another factor related to crime rates. More than 92% of adults 25 and older had completed at least a high school diploma in eight of the nation’s safest cities, well above the national rate of 86.6%.

However, higher incomes and an educated population alone may not explain all differences in local crime rates. Roman noted that, in some areas where crime is especially problematic, there are “structural disadvantages in that crime is such a cultural norm that it’s hard to fix.”

The FBI has attempted to discourage direct comparisons of crime rates between cities because local factors cause reporting to vary considerably between cities. Despite this characterization, Roman suggested that some comparison can be useful. “To me it's analogous to saying we shouldn’t rank how well schools are doing. How are you ever supposed to help the lowest-performing schools if you don’t tell them they’re the lowest-performing school?”

To identify the safest cities in America, 24/7 Wall St. reviewed violent crime rates among the nation’s cities with populations of 100,000 or more from the FBI’s 2013 Uniform Crime Report. Property crime rates also came from the FBI’s report. The data were broken into eight types of crime. Violent crime was comprised of murder and nonnegligent manslaughter, rape, robbery, and aggravated assault; and property crime was comprised of burglary, arson, larceny, and motor vehicle theft. In addition to crime data, we also reviewed median household income, poverty rates, and educational attainment rates from the 2013 Census Bureau’s American Community Survey.

ALSO READ: States Slashing Education Spending

These are the safest cities in America.

10. Sunnyvale, California

> Violent crimes per 100,000: 97

> Population: 148,160

> 2013 murders: 4 (87th lowest)

> Poverty rate: 7.3% (14th lowest)

> Pct. of adults with high school degree: 92.1% (51st highest)

> Violent crimes per 100,000: 97

> Population: 148,160

> 2013 murders: 4 (87th lowest)

> Poverty rate: 7.3% (14th lowest)

> Pct. of adults with high school degree: 92.1% (51st highest)

There were just 97 violent crimes committed per 100,000 people in Sunnyvale, the 10th lowest rate among large U.S. cities, and considerably lower than the national rate of 368 per 100,000 people. Robberies and aggravated assaults accounted for the bulk of the city’s violent crimes, and there were just four documented murder cases last year. Like in other large cities, safety is often accompanied by financial well-being. A typical household in Sunnyvale earned nearly $99,000 last year, more than in all but four other large cities. Sunnyvale residents were also among the least likely to live in poverty, with a poverty rate of just 7.3%. As is common among wealthier populations, Sunnyvale adults are well-educated. Nearly 60% of adults 25 and older had at least a bachelor’s degree as of last year, one of the highest attainment rates nationwide.

Wednesday, August 20, 2014

Best Low Risk Investments

1.

Certificates of Deposit

There is nothing more boring than a certificate of deposit. You can get it through your bank, your credit union or even your investment broker.

With a certificate of deposit (CD) you trade depositing your money for a specific length of time to a financial institution.

3. Money Market Funds

5. U.S. Savings Bonds

Annuities have a bad reputation with some investors because shady financial advisors over-promoted them to individuals where the annuity wasn’t the right product for their financial goals. Annuities don’t have to be scary things; they can help stabilize your portfolio over a long period.

There is nothing more boring than a certificate of deposit. You can get it through your bank, your credit union or even your investment broker.

With a certificate of deposit (CD) you trade depositing your money for a specific length of time to a financial institution.

In return, you get a set interest rate for that period

and it does not change, no matter what happens to interest rates. You are

locked in until maturity of the term length. You can withdraw from the CD early

for a penalty that is usually equal to three months’ worth of interest.

Why are CDs at the top of our best low risk investment

list? Because as long as you get a certificate of deposit with an FDIC-insured

financial institution, you are guaranteed to get your principal back as long as

your total deposits with that lender are less than $250,000. The government

guarantees that you cannot have a loss, and the financial institution gives you

interest on top of that.

How much interest you earn is dependent on the length of

the CD term and interest rates in the economy. Interest rates are low, but if

you lock in your money for many years you can get a little bit more interest.

2. Treasury Inflation Protected Securities (TIPS)

The U.S. Treasury has several types of bond investments

for you to choose from. One of the lowest risk is called a Treasury Inflation

Protection Security or TIPS. These

bonds come with two methods of growth.

The first is a fixed interest rate that doesn’t change

for the length of the bond. The second is built-in inflation protection that is

guaranteed by the government. Whatever rate inflation grows during the time you

hold the TIPS, your investment’s value rises with that rate.

For example, say you invest in a TIPS today that only

comes with a 0.35% interest rate. That’s less than certificate of deposit rates

and even basic online savings accounts. This isn’t

very enticing until you realize that, if inflation grows a 2% per

year for the length of the bond, then your investment value increases with that

inflation, and gives you a much higher return on your investment.

TIPS can be purchased individually or you can invest in a

mutual fund that owns in a basket of TIPS. The latter option makes managing

your investments easier, while the former gives you the ability to pick and

choose with specific TIPS you want.

3. Money Market Funds

A money market fund is a mutual fund with the main

purpose of not losing any value of your investment. The fund also tries to pay

out a little bit of interest as well to make parking your cash with the fund

worthwhile. The fund’s goal is to maintain a net asset value (NAV) of $1 per

share.

These funds aren’t foolproof, but do come with a strong

pedigree in protecting the underlying value of your cash. It is possible for

the NAV to drop below $1, but it is rare. The interest income is tiny, but

your money is relatively secure.

4. Municipal

Bonds

When a state or local government needs to borrow money,

it doesn’t use a credit card. Instead, the government entity issues a municipal

bond. These bonds, also known as munis, are except from federal income tax at

the very least. Most states and local municipalities also exempt income tax on

munis for issuers in the state, but talk to your accountant before making any

decisions.

What makes municipal bonds so safe? Not only do you avoid

income tax (which means a higher return compared to an equally risky investment

that is taxed) but the likelihood of the borrower defaulting is very low. There

have been some enormous municipality bankruptcies in recent years, but these

are very rare. Governments can always raise taxes or issue new debt to pay off

old debt, which makes holding a municipal bond a pretty safe bet.5. U.S. Savings Bonds

These are similar to TIPS because they are also backed by

the federal government. The likelihood of default on this debt is microscopic,

which makes them a very stable investment. There are two main types of US

Savings Bonds: Series I and Series EE.

Series I bonds consist of two components: a fixed

interest rate return and an adjustable inflation-linked return, making them

somewhat similar to TIPS. The fixed rate never changes, but the inflation

return rate is adjusted every six months and can also be negative (which of

course brings your total return down).

Series EE bonds just have a fixed rate of interest that

is added to the bond automatically at the end of each months, so you don’t have

to worry about reinvesting for compounding purposes. Rates are very low right

now, but there is an interesting facet to EE bonds: the Treasury guarantees the

bond will double in value if held to maturity, which is 20 years.

If you don’t hold to maturity you only get the stated

interest rate of the bond minus any early withdrawal fees. Another bonus to

look into: If you use EE bonds to pay for education, you might be able to

exclude some or all of the interest earned from your taxes.

Looking to purchase some Series I or Series EE Bonds? You

can do that directly through TreasuryDirect.gov.

6. AnnuitiesAnnuities have a bad reputation with some investors because shady financial advisors over-promoted them to individuals where the annuity wasn’t the right product for their financial goals. Annuities don’t have to be scary things; they can help stabilize your portfolio over a long period.

But talk with a good financial advisor first: Annuities

are very complex financial instruments with lots of catches built into the

contract.

There are several types of annuities. But in all cases,

when you purchase an annuity you make a trade with an insurance company. They

take a lump sum of cash from you. In return they give you a stated rate of

guaranteed return. Sometimes that return is fixed (with a fixed annuity),

sometimes that return is variable (with a variable annuity) and sometimes your

return is dictated in part by how the stock market does with guaranteed basic

level that gives you downside protection (with an equity indexed annuity).

If you get a guaranteed return, your risk is a lot lower.

Unlike the backing of the federal government, the insurance company backs your

annuity (and perhaps another company that further insurers the annuity

company). Nonetheless, your money is typically going to be very safe in these

complicated products.

7. Cash

Value Life Insurance

Another controversial investment is cash value life

insurance. First, this insurance pays out a death benefit to your beneficiaries

when you die; a term life insurance policy gives you this. Other types, known

as cash value policies, do that and also build up an investment account from

your payments. Whole life insurance and universal life insurance are the chief

cash value offerings.

While term life insurance is by far a cheaper option, it

only covers your death. One of the best perks of cash value life is you can

borrow against the accrued investment value throughout your life, but isn’t hit

with income tax. It is a clever way to pass some value onto your heirs without

either side getting hit with income tax.Monday, August 18, 2014

Safe Driving Tips for Back to School

1.

Slow down and obey all traffic laws and speed limits, both in

school zones and in neighborhoods surrounding the school.

2.

Comply with local school drop-off and pick-up procedures for the

safety of all children accessing the school.

3.

Avoid double parking or stopping on crosswalks to let children out

of the car. Double parking will block visibility for other children and other

motorists. Visibility is further reduced during the rain and fog seasons when

condensation forms on car windows.

4.

Avoid loading or unloading children at locations across the street

from the school. This forces youngsters to unnecessarily cross busy

streets—often mid-block rather than at a crosswalk.

5.

Prepare to stop for a school bus when overhead yellow lights are

flashing. Drive with caution when you see yellow hazard warning lights are

flashing on a moving or stopped bus.

6.

Stop for a school bus with its red overhead lights flashing, regardless

of the direction from which the driver is approaching. Drivers must not proceed

until the school bus resumes motion and the red lights stop flashing, or until

signaled by the school bus driver to proceed.

7.

Watch for children walking or bicycling (both on the road and the

sidewalk) in areas near a school.

8.

Watch for children playing and gathering near bus stops. Watch for

children arriving late for the bus, who may dart into the street without

looking for traffic.

9.

Watch for children walking or biking to school when backing up

(out of a driveway or leaving a garage).

Thursday, August 14, 2014

9 Ways to Prepare Your Child for Back to School

1. Re-Establish School Routines

Use the last few weeks of summer to get into a school-day

rhythm. "Have your child practice getting up and getting dressed at the

same time every morning," suggests school psychologist Kelly Vaillancourt,

MA, CAS. Start eating breakfast, lunch, and snacks around the times your child

will eat when school is in session.It’s also important to get your child used to leaving the house in the morning, so plan morning activities outside the house in the week or two before school.

2. Nurture Independence

Once the classroom door shuts, your child will need to

manage a lot of things on his own. Get him ready for independence by talking

ahead of time about responsibilities he's old enough to shoulder. Even if your

child is young, you can instill skills that will build confidence and

independence at school. Have your young child practice writing her name and

tying her own shoes. 3. Create a Launch Pad

At home, you can designate a spot where school things

like backpacks and lunch boxes always go to avoid last-minute scrambles in the

morning. You might also have your child make a list of things to bring to

school and post it by the front door.

4. Set Up a Time and Place for Homework Head off daily battles by making homework part of your child’s everyday routine. Establish a time and a place for studying at home. As much as possible, plan to make yourself available during homework time, especially with younger kids.

5. After-School Plans

School

gets out before most working parents get home, so it's important to figure out

where your children will go, or who will be at home, in the afternoons. You

might find an after-school program through the school itself, a local YMCA, or

a Boys and Girls Club. If possible, try to arrange your schedule so you can be

there when your child gets home during those first few days of school. It may

help your child adjust to the new schedule and teachers.

6. Make a Sick-Day Game Plan

Working parents also know the trials and tribulations of

getting a call from the school nurse when they can’t get away from the office. Before school begins, line up a trusted

babysitter or group of parents that can pinch hit for each other when children

get sick. And make sure you know the school’s policy. You may have to sign

forms ahead of time listing people who have your permission to pick up your

child.

7. Attend Orientations to Meet and Greet

Schools typically hold orientation and information

sessions before the start of each academic year. These are good opportunities

for you to meet the key players: your child’s teachers, school counselors, the

principal, and most importantly, front desk staff. 8. Talk to the Teachers

Of course, teachers are the reason your child is there.

When you talk to your child’s teachers, ask about their approach to homework.

Some teachers assign homework so kids can practice new skills while others

focus on the accuracy of the assignments they turn in. Ask for the dates of

tests and large assignments so you can help your child plan accordingly.

9. Make it a Family Affair

Together, you and your child can plan for success in

school. For instance, sit down with your child to create a routine chart. Ask

your child what she wants to do first when she first gets home from school:

play outside or do homework? Her answers go on the chart.

Tuesday, July 29, 2014

Neil Armstrong - Legacy Lives On!

By By Robert Z. Pearlman, collectSPACE.com

Bolden was joined at the ceremony by Aldrin and Collins, as well as Armstrong's backup commander, James Lovell, and Armstrong's sons Rick and Mark. During the event, Bolden presented Kennedy Space Center director Robert Cabana with an Apollo 11 patch that the astronauts carried to the moon in 1969 and then inscribed for the first crew to fly to Mars.

Armstrong, who famously declared his first small step on the moon a "giant leap for all mankind," died in 2012 at the age of 82.

In addition to updating the signs identifying the facility, a plaque and a spacesuit display in the building's lobby also pay tribute to the O&C's new namesake. Mark Armstrong also presented the center with a painting of his father from his days as an astronaut.

The five-story-tall O&C building, which was originally titled the Manned Spacecraft Operations Building at its opening in 1964, housed the quarters where the astronauts stayed while at the Kennedy Space Center prior to their launch.

"Since 1965, the Operations and Checkout building has been the final stop for America's astronauts before they embarked on their space journeys," Cabana said. "Like all the others, the crew of Apollo 11 left their mark, not only on the moon, but here in this building."

The building also included the high bay where the Apollo command, service and lunar modules were tested for flight before being stacked atop the Saturn V rocket.

The O&C's crew quarters were used throughout the Apollo program and for the subsequent Skylab, Apollo-Soyuz and space shuttle flights. In the early 1980s, the facility's high bay was used to support the European Spacelab modules that flew on the shuttle.

CAPE CANAVERAL, Fla. — NASA on Monday (July 21) paid tribute to the first man to walk on the moon by naming a building at its Florida spaceport where work is being advanced to send astronauts to Mars.

The "Neil Armstrong Operations and Checkout Building" at NASA's Kennedy Space Center added the late astronaut's name to the historic facility where he, his crew mates and their Apollo 11 spacecraft were readied for a launch to the moon 45 years ago this past week. Today, the building is being used to ready Orion, NASA's next-generation space capsule being developed to send astronauts beyond Earth orbit for the first time since the Apollo lunar landings.

"It is altogether fitting that we rename this facility," NASA Administrator Charles Bolden said during a ceremony held inside the Operations and Checkout (O&C) building, where hundreds of space workers gathered. "Armstrong was not only the first man to set foot on the moon... he challenged all of us to expand the boundaries of the possible."

"He, along with his crew Buzz Aldrin and Michael Collins, are a bridge from NASA's historic journey to the moon 45 years ago, to our path to Mars today."

Bolden was joined at the ceremony by Aldrin and Collins, as well as Armstrong's backup commander, James Lovell, and Armstrong's sons Rick and Mark. During the event, Bolden presented Kennedy Space Center director Robert Cabana with an Apollo 11 patch that the astronauts carried to the moon in 1969 and then inscribed for the first crew to fly to Mars.

"We present this patch because it's here where the Mars 1 crew will lift off on America's next bold mission," Bolden stated. "We salute Neil Armstrong and his crewmates for blazing a path that is leading us all the way from the first footprints on the moon to, very soon, the first footprints on Mars."

"Neil's spirit lives on in these halls, in our hearts, and now his name will be a constant reminder of where we've been and that in his words 'our opportunities are unlimited,'" Cabana said.

In addition to updating the signs identifying the facility, a plaque and a spacesuit display in the building's lobby also pay tribute to the O&C's new namesake. Mark Armstrong also presented the center with a painting of his father from his days as an astronaut.

"On behalf of the Armstrong family, I would like to thank you for this tremendous honor," Armstrong's youngest son Mark said. "It's our hope the name that graces this facility will inspire those who work here for many years to come."

The five-story-tall O&C building, which was originally titled the Manned Spacecraft Operations Building at its opening in 1964, housed the quarters where the astronauts stayed while at the Kennedy Space Center prior to their launch.

"Since 1965, the Operations and Checkout building has been the final stop for America's astronauts before they embarked on their space journeys," Cabana said. "Like all the others, the crew of Apollo 11 left their mark, not only on the moon, but here in this building."

The building also included the high bay where the Apollo command, service and lunar modules were tested for flight before being stacked atop the Saturn V rocket.

The O&C's crew quarters were used throughout the Apollo program and for the subsequent Skylab, Apollo-Soyuz and space shuttle flights. In the early 1980s, the facility's high bay was used to support the European Spacelab modules that flew on the shuttle.

The Neil Armstrong Operations and Checkout Building is in use today to assemble NASA's Orion spacecraft as the space agency prepares to embark on its "next giant leap" in space exploration, sending astronauts out to an asteroid and Mars. The facility is, at present, assembling the Orion capsule that will launch this December on the Exploration Flight Test-1 (EFT-1).

"I very much like that [Armstrong's] name will be on this building," Collins remarked. "He wouldn't have sought this honor, that was not his style, but I think he would be proud to have his name so closely associated with the heart and the sole of the space business."

"On Neil's behalf, thank you for what you do every day."

Follow collectSPACE.com on Facebook and on Twitter at @collectSPACE. Copyright 2014 collectSPACE.com. All rights reserved.

Subscribe to:

Posts (Atom)